The Federal Reserve has announced yet another rate hike this week. You’ve likely seen it all over the news. It’s been plastered all over social media and has likely been a topic of conversation at the water cooler.

It’s not a shocker that this happened. In fact, it’s our government’s only proven option to curb the rampant inflation that we’ve been seeing over the past year. The shocker today is the increment of increase, as it was the largest bump in over two decades of ¾ of a percent. That means that as of this year, the federal interest rate has risen 1.5%, a staggering increase compared to most years, and we’re barely halfway through 2022.

What does this mean for the housing market? The most obvious effect we all notice is a rise in mortgage interest rates, however, it’s the ripple effect here that will likely have a greater impact over time. As rates rise, purchasing power declines, leaving more homes on the market for longer (larger supply), generally causing prices to fall. While most of the “experts” don’t anticipate a massive drop in home values, it would be foolish for us to ignore the not-so-distant housing crisis of the late 2000’s.

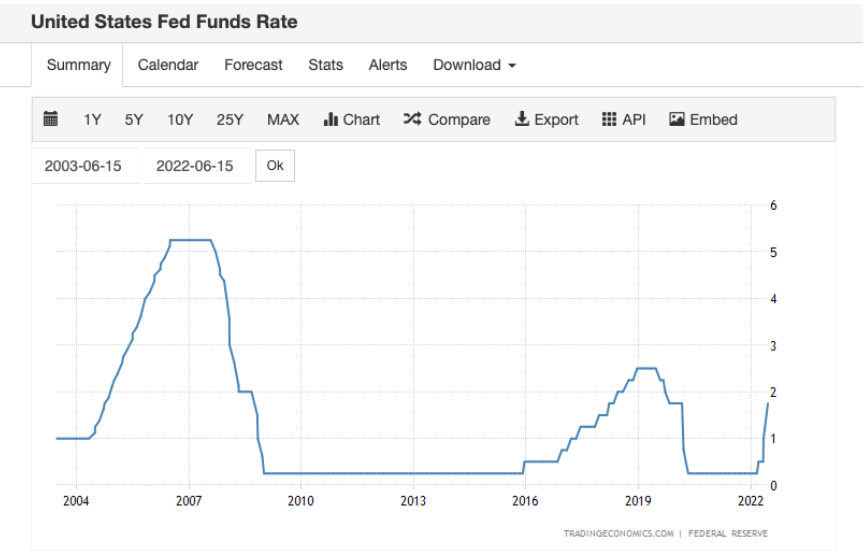

To put the sharp rate hike in perspective, below is a line graph depicting the federal interest rate over the last ~20 years. You’ll notice that the line has never been near vertical (as it is this month). Also, the last time the rate rose over 1.5% in a given year was in ‘05 and ‘06.

While nobody can truly predict what the result of these increases will yield, it would be smart to map out all possible scenarios in order to gauge your options. Whether you own a home, or are currently in the market to buy, we’re here to offer our expertise to ensure you make the right decision when the time comes.

Stay well,

-David Begg